Sustainability

Supply Chain Management

Basic Approach

The H.U. Group carries out purchasing activities based on its Procurement Policy. This policy incorporates the requirement for fair, stable, and sustainable procurement transactions. In addition, in order to fulfill the social responsibility of the supply chain in purchasing activities, we have compiled and thoroughly disseminated the Basic Policy on Business Partner Selection, a policy describing the efforts we would like our business partners to take alongside the Group. In addition, these policies are available in three languages, Japanese, English and Chinese.

Procurement Policy

Established on July 5th 2019

Revised on July 16th 2021

The H.U. Group engages in fair, stable, and sustainable procurement in order to contribute to human health through the creation of new value. We value our relationship with suppliers, pursuing the following basic approach to procurement in establishing mutual trust.

- We comply with the laws and social norms of every country in which we conduct business, striving to engage in procurement activities that consider respect for basic human rights, labor environments, occupational health and safety, child labor, and other related factors.

- We provide opportunities for free and transparent procurement with suppliers around the world, working to improve our competitive capabilities through active due diligence, including procurement from new business partners.

- We procure from excellent, highly trustworthy suppliers, selected based on a comprehensive list of factors including quality, price, delivery, technological capacity, Sustainability/EMS initiatives, business continuity, local procurement, and other factors.

Basic Policy on Business Partner Selection

Established on July 5th 2019

Revised on July 1st 2020

The H.U. Group selects excellent business partners based on our procurement policy and through the following assumed conditions.

- Compliance with laws, basic human rights, and corporate ethics in every country in which the entity conducts business activities

- Stable, healthy business infrastructure

- Quality, pricing, delivery are at appropriate levels and based on rational economics

- Compliance with non-disclosure agreements

- Ongoing activities that consider environmental preservation

- Capable of uninterrupted delivery activities, even in emergency situations

The H.U. Group recognizes the challenges and responsibilities involved in ensuring animal welfare, and is working to resolve societal issues while requiring its business partners to comply with local laws in each country and the Group's own regulations on issues including animal welfare.

Management

The Supply Chain Management Subcommittee, managed by the division head of Procurement at H.U. Group Holdings and with Procurement as its main driver, formulates and executes plans related to sustainable procurement. This subcommittee regularly monitors the progress of these activity plans and their results, and strives to act and take corrective action going forward.

Initiatives

When initiating a new transaction, we share our Procurement Policy and Basic Policy for Business Partner Selection. For existing business partners, we confirm the status of initiatives toward the realization of a sustainable society with business partners accounting for 80% of the order amount of each Group company approximately once every three years. Specifically, we utilize the United Nations Global Compact Self Assessment Tool (hereafter the UNGC SA), confirming details in a wide range of items: environmental conservation, occupational safety, and quality assurance, as well as corporate governance, fair trade, human rights (incl. child labor), information security, and more. We also use these results to evaluate our business partners, providing guidance for improvement based on the results of that evaluation.

Targets and Results

The H.U. Group conducts business partner surveys in a three-year cycle to ensure that each of the following group companies' business partners targeting primary suppliers of domestic and overseas group companies, and suppliers that account for the top 80% of annual procurement purchase amounts once during the cycle: (1) domestic subsidiaries, (2) overseas subsidiaries and (3) other consolidated subsidiaries, etc.

Through the use of the survey and meetings for exchanging views (direct dialogue), the Group recognizes issues, shares problem-solving cases, and takes other steps as part of its ongoing commitment to improvement activities and relationship enhancement, and ultimately to raising the ratio of business partners who are awarded an A-Class rating (percentage mark of 60% or above).

<First survey / Results>

- - FY2019:(1)

- Of 89 business partners of domestic subsidiaries, 89 responded to the survey (100%). Of the respondents, the ratio of those who were awarded an A-Class rating was 84.3%.

- - FY2020:(2)

- Of 61 business partners of overseas subsidiaries, 33 responded to the survey (54.1%). Of the respondents, the ratio of those who were awarded an A-Class rating was 49.2%.

- - FY2021:(3)

- Of 26 business partners of other consolidated subsidiaries, etc. (excluding the first year and the second year), 23 responded to the survey (88.5%). Of the respondents, the ratio of those who were awarded an A-Class rating was 69.2%.

<Second survey / Results>

- - FY2022:(1)

- Of 85 business partners of domestic subsidiaries, 85 responded to the survey (100%). Of the respondents, the ratio of those who were awarded an A-Class rating was 85.9%, representing an improvement of 1.6 percentage points compared to the first survey.

- - FY2023:(2)

- Of 62 business partners of overseas subsidiaries, 54 responded to the survey (87.1%). Of the respondents, the ratio of those who were awarded an A-Class rating was 64.5%, representing an improvement of 15.3 percentage points compared to the first survey.

- - FY2024:(3)

- Of 21 business partners of other consolidated subsidiaries, etc. (excluding the first year and the second year), 21 responded to the survey (100%). Of the respondents, the ratio of those who were awarded an A-Class rating was 85.7%, representing an improvement of 16.3 percentage points compared to the first survey.

Sustainability Roadmap for Supply Chain Management

The first survey was conducted from FY2019 to FY2021, targeting (1) domestic subsidiaries, (2) overseas subsidiaries, and (3) other consolidated subsidiaries, etc. ("Others" in the table below) for each fiscal year.

The second survey was conducted from FY2022 to FY2024.

<Two-Year Targets (FY2023-2024)>

For the two years from FY2023 until FY2024, specific targets derived from the cumulative results of the second survey were set, and efforts were made to achieve the targets of each fiscal year.

| KPI | [Reference results] 2022 |

2023 | 2024 | Two-Year Targets (2nd Survey) |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Major Category | Subcategory | Item | Unit | 2nd Survey・ (1) Domestic |

2nd Survey・ (2) Overseas |

2nd Survey・ (3) Others |

Cumulative total 2022-2024 |

||

| Acctual | Target | Acctual | Target | Target | |||||

| Promotion of Sustainable procurement for Tier 1 | Questionnaire collection rate | Questionnaire collection rate | % | 100 | 100 | 87.1 | 100 | 100 | |

| UNGC SA analysis | Class A rate (Score of 60% of total points or more) |

% | 85.9 | 70 | 64.5 | 90 | 75 | ||

| Class B rate (Score of 40-60% of total points) |

% | 11.8 | 20 | 19.4 | 8 | 20 | |||

| Class C rate (Score of 40% of total points or less) |

% | 2.4 | 10 | 3.2 | 2 | 5 | |||

| Share of non-responses | % | 0 | 0 | 12.9 | 0 | 0 | |||

Our Companies Subject to Survey

- (1)Domestic subsidiaries(FY2022):

H.U. Group Holdings, SRL, Fujirebio, NIHON STERY, Japan Clinical Laboratories, Care'x - (2)Overseas subsidiaries(FY2023):

Fujirebio Diagnostics(U.S.), Fujirebio Europe N.V.(Belgium) - (3)Other consolidated subsidiaries, etc.(FY2024):

Consolidated subsidiaries, etc. excluding (1) and (2) above

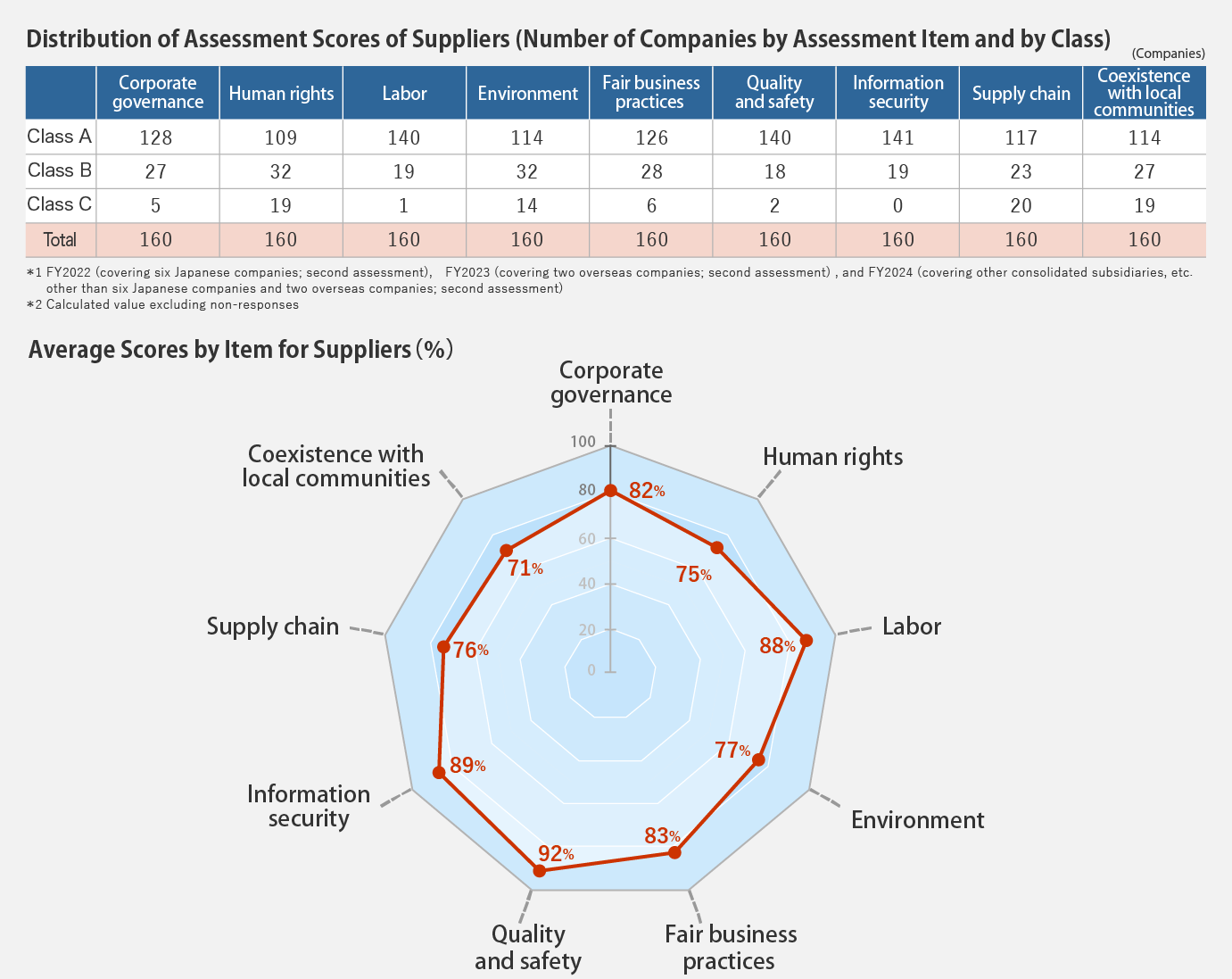

Status of Supplier Assessment in the Past Three Years*1 (Including Human Rights Due Diligence)*2

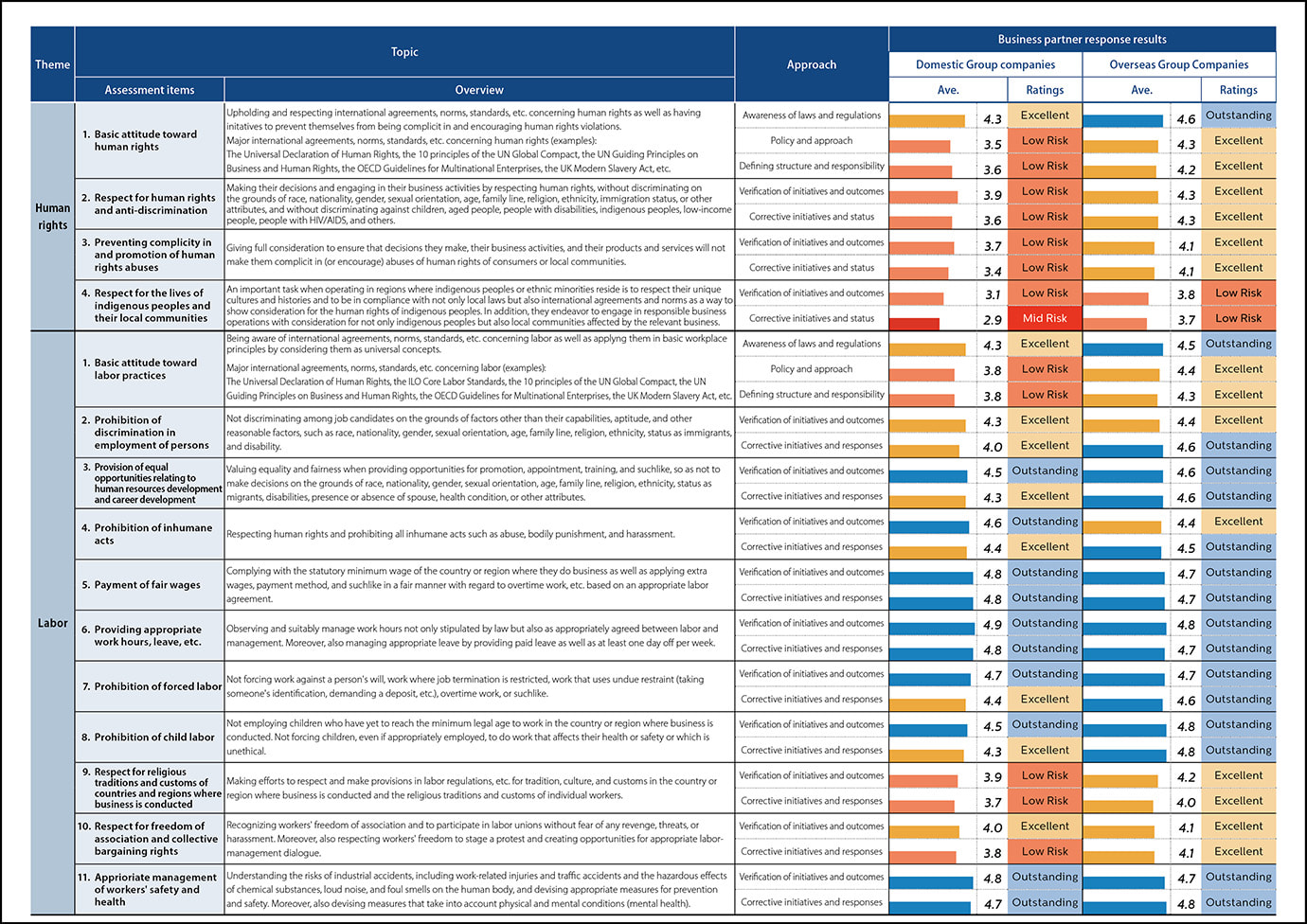

Assessment of human rights items

Based on the second survey* of business partners of our domestic and overseas group companies, we have analyzed human rights-related items, including labor aspects, and the results are as follows.

* Excluding non-responses, a total of 160 companies (85 companies in FY2022, 54 in FY2023, and 21 in FY2024)

[Summary]

- The collected results did not suggest any legal violations or serious concerns (accidents, lawsuits, etc.).

- In particular, analyzing the "human rights" and "labor" items by Japanese and overseas responses has shown that both have high risk with regard to "4. Respect for the lives of indigenous peoples, their local communities."

- In addition, we are working to improve initiatives and reduce risk with business partners that have high-risk items, while also investigating individual circumstances and exchanging information about best practices to make improvements.

- We intend to continue to conduct assessments of business partners as well as work to improve response rates and scores through communication suitable for every level.

Assessment results about human rights and labor[PDF:451KB]

-

Sustainability Subcommittee